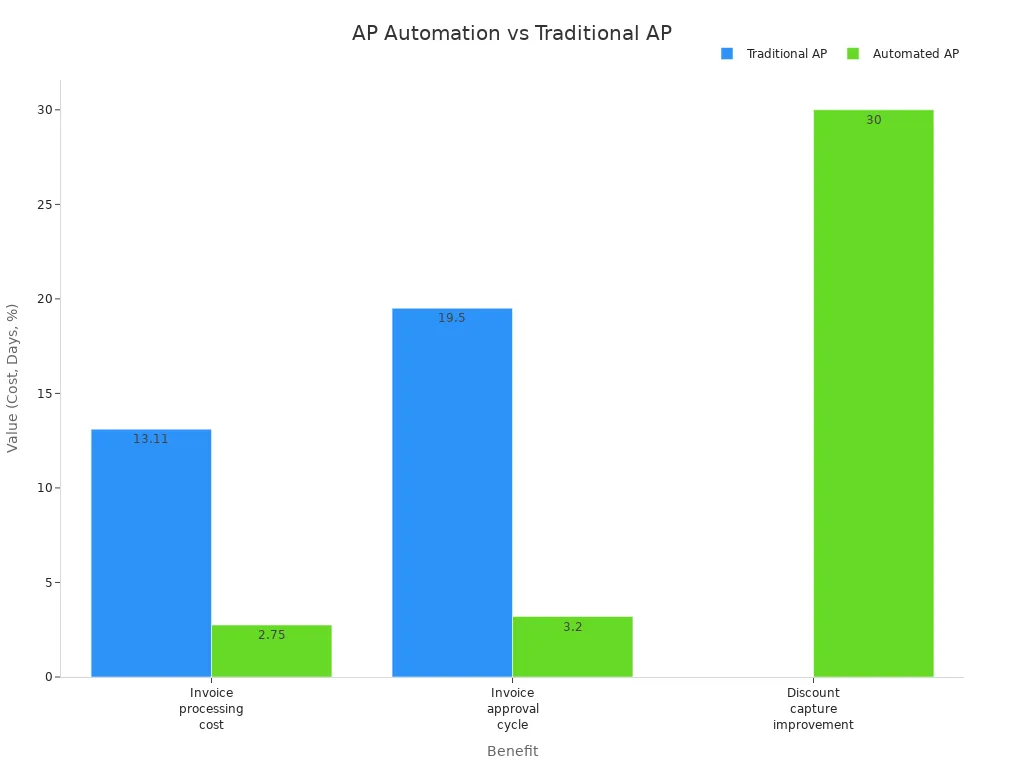

You gain measurable improvements when you automate accounts payable. AP automation uses smart software to handle invoices quickly and accurately. Businesses report up to 83% lower processing costs, 73% faster approvals, and a 75% drop in fraud risk.

Adoption Level | Percentage |

|---|---|

Partially Automated | 63% |

Fully Automated | <20% |

Mostly Manual | 14% |

You can boost efficiency, save money, and improve accuracy with ap automation benefits. Consider how these changes could help your business grow.

Key Takeaways

AP automation speeds up invoice processing, reducing handling time from 10.9 days to as little as 3.7 days, helping businesses pay vendors on time.

Automating accounts payable can cut processing costs by up to 90%, allowing businesses to allocate budget towards growth and innovation.

With fewer manual errors, AP automation enhances data accuracy, leading to better financial decisions and smoother vendor relationships.

1. AP Automation Benefits: Efficiency

Faster Processing

You want your business to move quickly. AP automation benefits you by speeding up invoice processing. When you use automation, you can process invoices in less time. Most companies need about 10.9 days to handle an invoice. Top-performing businesses finish this task in only 3.7 days. That is a 66% improvement.

Tip: Faster invoice processing means you can pay vendors on time and avoid late fees.

You also see a difference in approval times. With AP automation, the median time from receiving an invoice to approval drops to four days. Manual systems take about seven days. This speed helps your business stay ahead and respond quickly to changes.

Process invoices in less time

Approve payments faster

Keep vendors happy

Less Manual Work

Manual tasks slow you down and lead to mistakes. AP automation benefits you by reducing manual work. You spend less time entering data and checking for errors. Automation can lower the cost of processing each expense report to $6.85. Manual methods can cost up to $10 per invoice.

Manual data entry errors happen in 18% of receipts. These mistakes waste time and money. Automation cuts these errors and helps your team work better. Many organizations see a 70% or greater reduction in processing time after switching to automation.

Spend less time on paperwork

Reduce costly errors

Free up your team for important work

When you use AP automation, you boost productivity. Your team can focus on tasks that help your business grow.

2. Cost Savings

Lower Costs

You want to save money on every invoice your business processes. AP automation benefits you by cutting costs in a big way. Manual invoice processing can cost anywhere from $12 to $40 per invoice. Automated solutions drop this cost to just $1 or $2 per invoice. That means you can save up to 90% on processing expenses.

Spend less on every invoice

Free up budget for other business needs

Make your accounts payable team more efficient

When you use automation, you also reduce the need for extra staff and overtime. Your team can handle more invoices without working longer hours. This helps you control labor costs and keep your business running smoothly.

Tip: Lower costs mean you can invest more in growth and innovation.

Fewer Penalties

Late payments can hurt your business. You may face penalties, lose discounts, or damage vendor relationships. AP automation helps you avoid these problems by making sure invoices get paid on time.

Here is how automation helps you reduce penalties and capture savings:

Benefit/Strategy | Description |

|---|---|

Streamlined Invoice Processing | Reduces processing times and minimizes the risk of late payments by automating the invoice cycle. |

Enforced Clear Payment Terms | Ensures compliance with agreed-upon schedules by categorizing invoices based on their terms. |

Automated Reminders and Scheduling | Helps avoid last-minute scrambles and ensures timely payments, allowing for early payment discounts. |

Enhanced Vendor Communication | Facilitates transparent communication, fostering trust and collaboration with vendors. |

Cost Reduction | Studies indicate reductions of up to 80% in processing costs and capturing early payment discounts. |

You can avoid late fees and take advantage of early payment discounts. This keeps your vendors happy and your business reputation strong.

3. Accuracy

Fewer Errors

You want your accounts payable process to run smoothly. Manual data entry often leads to mistakes. These errors can cost your business money and harm vendor relationships. AP automation benefits you by reducing the risk of human error.

Here is a quick look at error rates:

Process Type | Error Rate |

|---|---|

Manual | 3.6% |

Automated | <1% |

When you use automation, you process invoices with fewer mistakes. Automation checks data against purchase orders and catches errors before they cause problems. You avoid costly corrections and keep your records clean.

Manual AP is prone to human error, especially during data entry.

Errors in manual processing can lead to significant business costs and damage relationships with vendors.

Tip: Fewer errors mean you spend less time fixing problems and more time growing your business.

Reliable Data

You need reliable data for good financial decisions. AP automation benefits you by making your records accurate and easy to track. Automation follows your company’s rules and regulations, so you avoid penalties from mistakes.

Automation processes transactions according to internal policies and regulations, minimizing the risk of financial penalties due to manual errors.

AP automation captures data from invoices and cross-verifies it with purchase orders, significantly reducing errors.

Comprehensive audit trails enhance transparency and accountability in financial operations.

Automation creates a digital trail for every transaction. You can see who approved each invoice and how much was paid. This makes audits easier and helps you report your finances with confidence.

Note: Reliable data supports better decisions and keeps your business ready for audits.

4. Compliance

Audit Trails

You need clear records to show every step in your accounts payable process. AP automation creates digital audit trails that log each action on every invoice. You see who approved payments, when they did it, and what changes happened. This makes your audit preparation much easier and faster.

Every invoice action gets recorded with a timestamp.

You can trace the full history of each payment.

Customizable reports help you meet audit requirements quickly.

AP automation benefits you by making your records accurate and secure. You reduce the risk of missing documents or lost approvals. Auditors can review your digital records without searching through paper files.

Tip: Digital audit trails help you prove compliance and build trust with regulators.

Regulatory Ease

You face many rules in business. AP automation helps you follow important standards like the Sarbanes-Oxley Act (SOX), HIPAA, PCI DSS, SOC 1, SOC 2, and KYC. These rules protect your company, your customers, and your data.

Description | |

|---|---|

HIPAA | Protects sensitive patient information and requires privacy for medical records. |

PCI DSS | Ensures the security of credit card data. |

SOC 1 | Protects customer data and accounts from unauthorized access. |

SOC 2 | Protects customer information during storage and transmission. |

KYC | Requires verification of customer identity to prevent fraud. |

AP automation keeps your financial records updated and ready for review. You meet reporting deadlines and avoid penalties. You also show transparency and accountability in your operations.

Note: Following compliance standards keeps your business safe and ready for growth.

5. Security

Fraud Reduction

You want to protect your business from fraud. AP automation helps you spot and stop suspicious activity before it causes harm. The system checks every invoice and flags anything unusual. You get alerts if someone tries to change payment details or submit a fake invoice. This quick response keeps your money safe.

AP automation uses vendor validation to cross-check vendor information. Only approved vendors can receive payments. This step blocks payment diversion and stops fraudsters from sneaking into your system. You also see a digital audit trail for every transaction. You know who approved each payment and when they did it. This traceability makes it hard for anyone to hide dishonest actions.

Tip: Strong fraud controls build trust with your vendors and your team.

Data Protection

You handle sensitive financial data every day. AP automation gives you powerful tools to keep this information secure. The system uses authentication controls like multi-factor authentication and role-based access. Only authorized users can view or approve payments. This keeps your data out of the wrong hands.

Real-time monitoring adds another layer of protection. The software watches for unusual behavior and sends instant alerts if it finds a problem. You can act fast to prevent data breaches.

Here are some key security features you get with AP automation:

Security Feature | Description |

|---|---|

Enforces multi-factor authentication and role-based access for users. | |

Digital audit trails | Logs every action for traceability and accountability. |

Real-time monitoring | Detects unusual behavior and sends alerts for quick action. |

Vendor validation | Cross-references vendor data to ensure only legitimate vendors get paid. |

You keep your financial information safe and your business reputation strong.

6. Data Visibility

Real-Time Access

You need to see your accounts payable data as it happens. AP automation gives you real-time access to every invoice and payment. You can check the status of any transaction without waiting for manual updates. This instant visibility helps you make quick decisions and spot issues before they grow.

Here are some key benefits you get from real-time data access:

Improved Supplier Relationship Management: You can use self-service portals to let suppliers check their payment status. This builds trust and keeps vendors happy.

Increased Cash Flow Visibility: Dashboards show your current cash position and help you predict future needs. You always know where your money stands.

Enhanced Compliance Reporting: Digital audit trails keep every step recorded. You can prove compliance and make audits easier.

Tip: Real-time access means you never have to guess about your AP process. You always know what is happening.

Better Reporting

You want to understand how your AP team performs. AP automation gives you powerful reporting tools. You see real-time insights into invoice processing and performance metrics. This helps you find areas to improve and make smart, data-driven decisions.

With AP automation, you can track key performance indicators (KPIs) like processing time, error rates, and payment cycles. These reports show the value of automation and help you plan for the future. You can share these results with your team and leadership to highlight your progress.

Note: Better reporting means you can measure success, fix problems fast, and show the impact of your AP automation efforts.

7. Vendor Satisfaction

Timely Payments

You want your vendors to trust your business. AP automation helps you pay invoices on time, which builds strong relationships. When you automate your accounts payable process, you create predictable payment schedules. Vendors know when they will get paid, so they can plan their finances better. This reliability encourages vendors to prioritize your business.

Timely payments help you avoid late fees and keep vendors happy.

Consistent payments build trust and loyalty.

Vendors may offer discounts for prompt payments.

AP automation reduces errors in transactions. Fewer mistakes mean smoother interactions with your suppliers. You also gain a clear audit trail for every payment, which helps resolve disputes quickly. Vendors appreciate transparency and reliability.

Tip: Paying vendors on time strengthens your reputation and can lead to better deals.

Improved Communication

You need clear communication with your vendors. AP automation gives you tools to keep everyone informed. Vendors can check their invoice status in real time using integrated portals. This reduces frustration and cuts down on unnecessary emails or calls.

Benefit | Description |

|---|---|

Automation ensures invoices are paid on time, building vendor trust. | |

Better Transparency | Vendor portals let suppliers track payments anytime, increasing confidence. |

Streamlined Communication | Automated systems free up your team to focus on building strong vendor relationships. |

Your team spends less time on manual tasks and more time solving problems or answering vendor questions. Communication logs create a complete record, so you avoid miscommunication. Vendors feel valued when you respond quickly and keep them updated.

Real-time payment tracking keeps vendors informed.

Direct communication builds stronger partnerships.

Clear records help resolve issues fast.

Note: Strong communication leads to lasting vendor relationships and smoother business operations.

8. Teamwork

Strategic Focus

AP automation changes how your team works. You no longer spend hours on repetitive tasks. Instead, you can focus on work that helps your business grow. When you automate accounts payable, you free up time for important projects.

You can spend more time on financial analysis and planning.

Your team can work on vendor negotiations and cash flow improvements.

You have more capacity to help with strategy and future growth.

When you remove manual steps, your team can use their skills in new ways. This shift lets you add more value to your company. You can help your business make better decisions and reach its goals faster.

Higher Morale

Happy teams do better work. AP automation helps your team feel more engaged and satisfied. When you reduce boring, repetitive tasks, your team can focus on interesting projects.

Your team can work from home more easily with digital tools.

Productivity and accountability improve when everyone knows their role.

Employees feel more valued when they can solve problems and innovate.

Job satisfaction rises, and turnover rates drop.

When your team feels trusted and empowered, morale goes up. People enjoy their work more and want to stay with your company. This positive energy leads to better results for your business.

With AP automation, you build a team that works smarter, not harder. You create a workplace where everyone can succeed.

9. Standardization

Consistent Workflows

You want your accounts payable process to run smoothly every time. AP automation gives you consistent workflows that follow the same steps for every invoice. This standardization means you do not have to guess what comes next. You set clear rules, and the system follows them. Your team knows exactly how to handle each invoice, which keeps everyone on the same page.

Consistent workflows help you avoid confusion and delays. You see faster approvals and fewer bottlenecks. When you automate, you can scale your operations without hiring more staff. Your business grows, but your process stays simple.

Here is a quick look at the measurable benefits of standardized AP workflows:

Benefit Description | Measurable Impact |

|---|---|

Shortens invoice processing time and manual labor costs | Increases efficiency and reduces costs |

Gain real-time visibility into cash flow and performance | Enhances decision-making capabilities |

Minimize human error and payment discrepancies | Reduces financial risks |

Improve vendor relationships with on-time payments | Strengthens partnerships and trust |

Streamline approval workflows and reduce bottlenecks | Accelerates processing times |

Scale operations without increasing headcount | Supports growth without additional costs |

Advance sustainability and CSR goals through paperless AP | Contributes to environmental objectives |

Tip: Standardized workflows make it easy to train new team members and keep your process running smoothly.

Fewer Mistakes

You want fewer errors in your accounts payable process. Standardization helps you reach this goal. When you use AP automation, the system checks every invoice the same way. You catch mistakes before they become problems. This reduces payment discrepancies and financial risks.

Automated workflows minimize human error. You do not have to worry about missing steps or forgetting approvals. Your records stay accurate, and your team spends less time fixing mistakes. Vendors receive payments on time, which builds trust and keeps your business reputation strong.

Reduce costly errors

Keep financial data accurate

Build stronger vendor relationships

Note: Fewer mistakes mean more confidence in your financial operations and better results for your business.

10. AP Auto

Kofax AP Essentials™

You want a solution that makes accounts payable simple and powerful. Kofax AP Essentials™ gives you advanced automation for every step of your AP process. You can handle any invoice type, capture data with smart technology, and keep your workflows consistent. This tool helps you save time, cut costs, and improve accuracy.

Here is how Kofax AP Essentials™ stands out from other AP automation solutions:

Feature | Kofax AP Essentials™ | Other AP Solutions |

|---|---|---|

Advanced cognitive invoice capture | Yes | Varies |

Handles any invoice type | Yes | No |

Seamless ERP integration | Yes | Varies |

Automated process orchestration | Yes | Varies |

Intelligence-assisted vendor verification | Yes | Varies |

Duplicate entry detection | Yes | Varies |

Mobile approval options | Yes | Varies |

You see real results when you use Kofax AP Essentials™:

You process invoices faster and reduce manual work.

You lower costs and improve supplier relationships with timely payments.

You get more accurate data and fewer errors.

Your team spends less time on paperwork and more time on valuable tasks.

Kofax AP Essentials™ connects with major ERP systems like SAP, Oracle NetSuite, and Coupa. You automate general ledger coding and keep your data in sync. The solution offers rapid setup, so you start seeing benefits right away.

Tip: Kofax AP Essentials™ helps you build a smarter, more efficient AP process that supports your business growth.

You see real change when you use ap automation benefits.

Strengthen security and increase transparency

Improve efficiency and give your team strategic roles

Gain real-time financial insights

Start by reviewing your current process, setting goals, and exploring automation solutions.

FAQ

What is AP automation?

AP automation uses software to process invoices and payments. You save time, reduce errors, and improve your accounts payable workflow.

How does AP automation help you save money?

You lower invoice processing costs, avoid late fees, and capture early payment discounts. Automation lets you use your budget for growth.

Can AP automation improve security?

Yes! You protect your business with fraud detection, secure data access, and digital audit trails. Automation keeps your financial information safe.